About us

Since our inception, we have played a vital role in contributing to the growth of the Indian financial ecosystem. For us, it has always been about getting the maximum value by going a little further to discover opportunities for growth.

We have a reputation for providing well-managed, consistent, and balanced investment opportunities for our investors, thus letting us measure our success on a human scale; in the clients, investors, and team who know us as trusted partners.

Our Legacy

At PINC Wealth, we strive to build purpose-driven portfolios based on fundamental research and focused on realistic returns.

Our confidence originates from a 4 decade long legacy in financial services, where we've assisted clients in successfully navigating unforeseen financial situations.

Trust us to help you find the right possibilities in an ever-changing financial landscape. Our investment process was created to assist you in your wealth generation and preservation journey.

Why Invest In Indian Market?

Beginning of the Bull Market

Data suggests that when the GDP of any nation grows from $2 trillion to $5 trillion it experiences the biggest bull market.

Global Markets

China, In 5 years (2004-2009)

Hang Seng grew from 8500 to 32000- 4x gain

USA, In 11 years (1977-1988)

Dow Jones grew from 700 to 12000- 15x gain

Japan, in 8.5 years (1978-1986)

Tokyo Stock Exchange grew from 2000 to 37000- 19x gain

India

GDP is currently worth $2.75 trillion, with a goal of reaching $5 trillion this decade.

Leadership Team

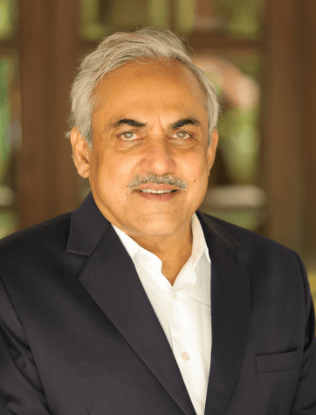

Mr. Gaurang Gandhi

Founder and MD, PINC

Over 4 decades of comprehensive experience in the financial services industry with strong leadership.

Committed to building scalable and sustainable businesses across the financial sector.

Mr. Shreenidhi P.

Research Head, PINC Wealth

CFA level 2 with extensive experience as Senior Equity Research Analyst.

Responsible for meeting management of various portfolio companies, attending concalls and preparing research reports and notes.

Related Articles

How will the US Fed rate cut impact inflation, Indian markets and your investment portfolio?

US Fed rate cuts influence Indian markets, currency trends, and smallcase stocks. Explore sectors that benefit, risks, and smart investment strategies for 2025.

Know more

What is WACR, and why does RBI retaining WACR matter for your portfolio?

Understand WACR and RBI's revised liquidity framework. Learn how these monetary policy changes impact your smallcase investment and portfolio returns.

Know more

‘Bite-sized’ smallcase investments: Low entry-cost portfolios for new and young investors

Making investment even easier and simpler with ‘bite-sized’ smallcase portfolios. Here’s a guide for beginners on how to start and build long-term wealth.

Know more

Top portfolio risk assessment tools and techniques that every smallcase investor should know

Learn about the top portfolio risk assessment tools and techniques that every smallcase investor should know to analyse and manage the potential risk, and how financial advisors help in this effectively.

Know moreMeet the people

we served!

PINC Compounder Smallcase has simplified my investment journey. Seriously, investing has never been easy for me! Here in a single click, I could access a balanced portfolio. Thanks PINC.

Mr. Akhilesh

I was hesitant about investing, but PINC Smallcase changed that. Talking to their team and looking at their growth gave me confidence. I've seen my investments grow steadily since then. I'm impressed!

Devendra Palan

As someone with limited knowledge about the stock market, I found Pinc smallcase to be a reliable and accessible platform. Their detailed reports and analysis have given me a deeper understanding of the stocks in my portfolio. I feel confident in managing my investments.

Pratik Gandhi

Subscribe to our email list

Sign up for Expert Insights

Your Gateway to Smarter Wealth

Management!